Global Workforce Management

International Employee Contract Fees: Typical Costs

Discover international employee contract fees, what’s included in the price, and how EOR services simplify global hiring costs worldwide hiring.

Lucas Botzen

Business Expansion and Growth

9 mins read

Our Employer of Record (EOR) solution makes it easy to hire, pay, and manage global employees.

Book a demoThe definition of a subsidiary is a company whose ownership is retained and controlled by a parent company. A subsidiary may also be referred to as a subsidiary company or a daughter company, while the parent company is otherwise known as a holding company. In more technical terms, for the parent to hold a controlling interest in the subsidiary company, it has to have at least 50 percent control of its stock.

A subsidiary is a separate legal entity to its parent for tax, regulation, and liability purposes. However, the parent benefits from the subsidiary by enabling it to perform functions related to the business they are operating (e.g., manufacturing components needed to produce the goods sold).

First, you must specify the locations of your employees. If your company has employees scattered and severely varied all over the world, then opening a foreign subsidiary may not be the best choice for you. The rule of thumb states that there should be five employees in the same location to consider opening a local subsidiary office there. (READ: [How to pay out your remote employees?](https://www.rivermate.com/blog/how-to-pay-out-the-remote- employees))

Second, it must also be made sure that your company’s investors and lenders are in full support of this hefty move. It makes no sense to hide such a huge decision from the people who will provide your company the finances you will need to buy a lot, construct an office, and generally set up a subsidiary company. Being transparent and open to your investors and lenders will also lessen the chance of cultivating conflict among the parties involved in your company.

are considered

Third, you will also need to consider the tangible and intangible aspects that will be transferred from your company to the subsidiary corporation. A significant portion of aspects like responsibilities, assets, and liabilities will obviously be fetched to the new business entity. Estimate how much of these aspects will be needed to let the subsidiary functionally operate, and determine whether you have enough of these to still manage both entities well. For instance, to let the subsidiary get started with your business operations, a chunk of your working capital will be necessitated. Whether you have enough capital should be well thought about. This is also one of the many reasons why opening a local subsidiary is such a significant move—most subsidiary companies are set up only by the most valuable corporations. A corporation only decides to expand if it has the means to do so.

Every business venture will have corresponding benefits and drawbacks. How these drawbacks will be mitigated may determine the future of the company. But before that, listing the pros and cons of opening a subsidiary will totally get the mitigation process going. Below is a table that details the pros and cons of opening a local subsidiary.

A good number of companies has proven just how effective opening a local subsidiary is. For example, Berkshire Hathaway’s acquisition of many diverse firms is a strategy related to buying undervalued assets and holding onto them until they succeed. While Berkshire Hathaway acquires these subsidiaries, they can still operate independently while gaining access to a much broader financial resource. Now, Berkshire owns more than 270 subsidiaries.

Alphabet Inc. also owns many subsidiaries that perform unique operations and add value to the parent company through diversification, revenue, earnings, and research and development. One subsidiary of Alphabet is the Sidewalk Labs, a startup that aims to modernize public transit in the United States. It provides Alphabet with a business unit that develops technology that will eventually help the entire company.

A sense of teamwork, collaboration, and partnership toward goals can be evident in just investing in a local subsidiary. As a parent company, it is your job to nurture and develop your daughter's company in hopes that it will one day help you get back on your feet when things go upside down.

A company could have a plethora of reasons when they decide to open a local subsidiary. It could expand their market, limit and contain the losses, or increase engagement among company employees. Whatever these reasons are, it is always important to assess the risks, the costs and potential, and determine the best possible move for your company.

Subsidiary accounts are accounts that are kept within the subsidiary’s ledger. The ledger then summarizes the subsidiary accounts into a control account in the general ledger. Subsidiary accounts are used to track data at a particular level for certain types of transactions like accounts receivable and accounts payable.

A subsidiary ledger or a subledger is a group of similar accounts that have their combined balances equal to the balance indicated in a specific general ledger account. The general ledger account that summarizes a subsidiary ledger's account balances is called a control account or a master account. A subsidiary ledger should provide details behind entries in the general ledger used in accounting.

A subsidiary cooperative is any organization that has the majority of its membership or shareholders come from a cooperative. It receives technical, managerial, and financial assistance from a cooperative.

As previously pointed out, creating subsidiaries is a significant decision by any company. Some decline the idea but some push through anyway. The reasons why some companies make subsidiaries include the following:

According to Corporate Finance Institute, foreign nationals who look into setting up a subsidiary in South Africa will need to prepare 2.5 million South African Rands (165,868.75 United States Dollars) as an investment to the company. These funds must first be in your existing bank accounts and eventually transferred to a South Africa bank. You will also need to submit proof that your company has South African employees working for your company for more than six months already. The following steps are then followed:

A subsidiary company operates as a unique, separate, and distinct corporation to the parent or holding company. Therefore, they have the authority to perform, but not limited to, the following:

Best Buy is am American multinational consumer electronics retailer headquartered in Richfield, Minnesota.The subsidiaries it owns includes Best Buy Mobile, Geek Squad, Magnolia Home Theater, and Pacific Sales.

Not necessarily. The registration of the subsidiary company is a decision that rests in the business owner or the parent company. This is because subsidiaries are not legally required to be incorporated. In other words, the incorporation of the subsidiary as a legally separate entity is dependent on how the parent company is utilizing it.

Lucas Botzen is the founder of Rivermate, a global HR platform specializing in international payroll, compliance, and benefits management for remote companies. He previously co-founded and successfully exited Boloo, scaling it to over €2 million in annual revenue. Lucas is passionate about technology, automation, and remote work, advocating for innovative digital solutions that streamline global employment.

Our Employer of Record (EOR) solution makes it easy to hire, pay, and manage global employees.

Book a demo

Global Workforce Management

Discover international employee contract fees, what’s included in the price, and how EOR services simplify global hiring costs worldwide hiring.

Lucas Botzen

Taxation and Compliance

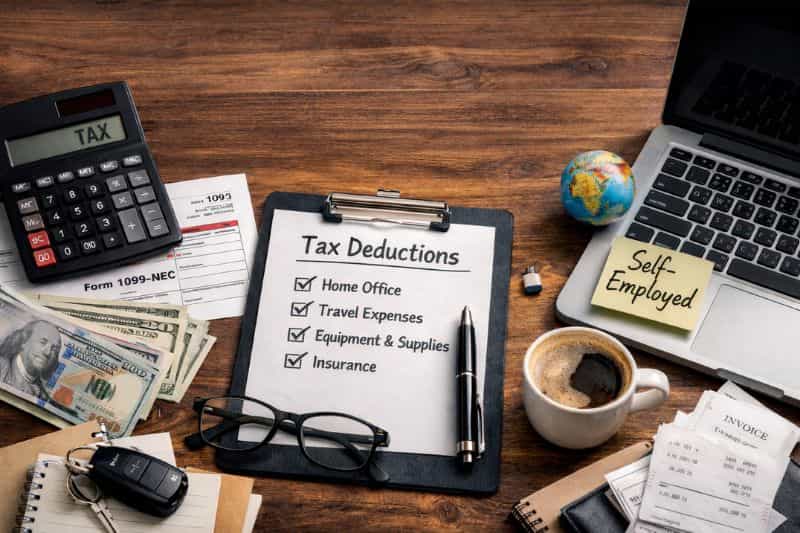

Learn how 1099 write-offs influence contractor rates, self-employment tax, compliance handling, worker misclassification and your current hiring strategy.

Lucas Botzen

Business Expansion and Growth

Learn about the risks of expanding a business internationally such as geopolitical, technological, workforce, cultural, and supply chain risks in 2026 and beyond.

Lucas Botzen