Navigating the compensation landscape in Russia requires a clear understanding of local market dynamics, statutory requirements, and common practices. Establishing competitive and compliant salary structures is crucial for attracting and retaining talent, ensuring operational stability, and adhering to national labor laws. This involves considering various factors, including industry standards, regional variations, employee qualifications, and the prevailing economic conditions.

Employers operating in Russia, whether through a local entity or an Employer of Record (EOR) service, must stay informed about evolving regulations and market expectations. Compensation packages typically extend beyond base salary to include mandatory contributions, potential bonuses, and other allowances, all of which contribute to the total cost of employment. Understanding these components is key to effective workforce management and budgeting.

Market Competitive Salaries

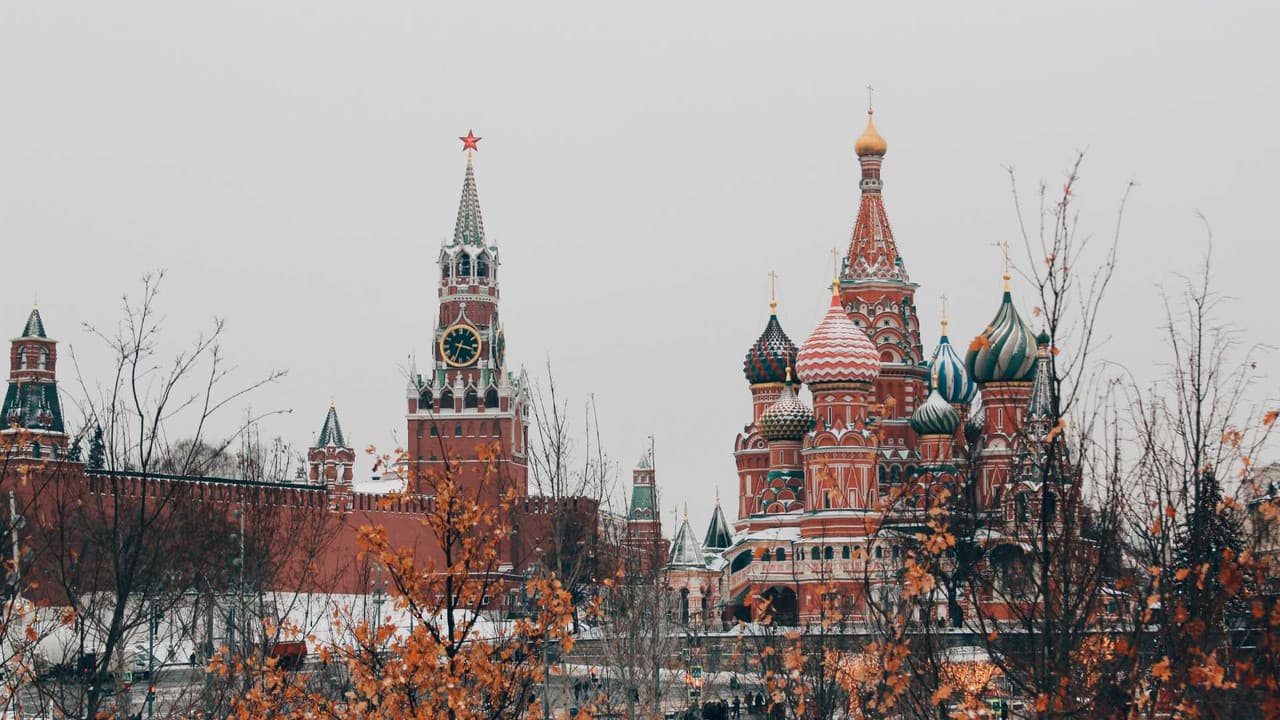

Salaries in Russia vary significantly based on industry, company size, location, and the specific role and experience level. Major cities like Moscow and Saint Petersburg generally command higher salaries compared to regional areas due to higher costs of living and greater concentration of international and large domestic companies. High-demand sectors such as IT, finance, oil and gas, and pharmaceuticals often offer more competitive compensation packages.

While specific salary ranges for 2026 will continue to evolve, general market data indicates typical ranges for common roles. For instance, entry-level administrative positions might range from RUB 40,000 to RUB 70,000 per month, while experienced IT professionals or senior managers could command salaries well over RUB 200,000, potentially reaching RUB 500,000 or more in top-tier companies and roles.

Factors influencing market salaries include:

- Industry: High-growth or high-revenue industries typically pay more.

- Location: Significant difference between major cities and regions.

- Company Size and Type: Larger companies, especially international ones, often offer higher salaries and better benefits.

- Role and Experience: Specialized skills and extensive experience are highly valued.

- Economic Conditions: Inflation rates and overall economic growth impact salary adjustments.

Minimum Wage Requirements and Regulations

Russia has a federally mandated minimum wage, known as the Minimum Monthly Wage (MMW) or МРОТ (Минимальный размер оплаты труда). This rate is set at the federal level but can be supplemented by regional agreements, which may establish a higher minimum wage for specific territories. Employers must adhere to the higher of the federal or applicable regional minimum wage.

The federal minimum wage is reviewed and typically adjusted annually, effective from January 1st. The government has set a goal to increase the minimum wage significantly in the coming years, aiming for it to exceed the minimum subsistence level. The specific rate for 2026 is usually announced towards the end of the preceding year.

| Period | Federal Minimum Monthly Wage (RUB) |

|---|---|

| January 2023 | 16,242 |

| January 2024 | 19,242 |

| January 2025 | 22,440 |

| January 2026 | 27,093 |

Employers must ensure that the total monthly earnings of an employee working a full standard workweek are no less than the applicable minimum wage, before deducting personal income tax (PIT). This includes base salary, bonuses, and other incentive payments, but excludes payments for overtime, night work, weekend work, and work in harmful/hazardous conditions.

Common Bonuses and Allowances

Beyond the base salary, compensation packages in Russia often include various bonuses and allowances, which can be performance-based, statutory, or company-specific.

Common types of bonuses and allowances include:

- Performance Bonuses: Paid based on individual, team, or company performance against set targets (e.g., quarterly, annual bonuses).

- Annual Bonuses (13th Salary): A common practice, though not legally mandated for all employees, where employees receive an extra month's salary at the end of the year.

- Holiday Bonuses: Payments made in connection with public holidays or company events.

- Regional Coefficients and Allowances: Mandated additional payments for employees working in certain regions with harsh climates or difficult living conditions (e.g., Far North regions). These are statutory requirements.

- Material Aid: One-off payments provided to employees in specific circumstances (e.g., marriage, birth of a child, illness), often tax-exempt up to a certain limit.

- Meal Allowances: Some companies provide meal vouchers or a fixed allowance for food.

- Transportation Allowances: Assistance with commuting costs, especially in large cities.

The structure and frequency of bonuses are typically outlined in the employment contract, collective bargaining agreement, or internal company regulations. Statutory allowances, like regional coefficients, are mandatory where applicable.

Payroll Cycle and Payment Methods

The standard payroll cycle in Russia is monthly, but employers are legally required to pay salaries at least twice per month. Payments must be made no more than 15 calendar days after the end of the period for which the salary is calculated. For example, payment for the first half of the month (advance payment or 'avans') must be made between the 16th and 25th of the current month, and the final payment for the full month must be made between the 1st and 15th of the following month.

Specific payment dates must be fixed in internal company documents, such as the labor rules or collective agreement. If the payment date falls on a weekend or public holiday, payment must be made on the preceding working day.

Salary payments are predominantly made via bank transfer directly to the employee's designated bank account. Cash payments are still permissible but less common, especially for larger companies. Employers must provide employees with a payslip detailing the components of their salary, deductions (like PIT), and the net amount paid.

Salary Trends and Forecasts

Salary trends in Russia are influenced by several factors, including inflation, labor market supply and demand, government policies (like minimum wage increases), and the overall economic climate. In recent years, there has been pressure for salary increases, particularly in sectors facing talent shortages.

Forecasts for 2026 suggest continued upward pressure on salaries, driven by inflation and the ongoing competition for skilled labor, especially in IT, engineering, and certain manufacturing sectors. The government's commitment to increasing the minimum wage will also impact the lower end of the salary scale and potentially push up wages slightly across the board. However, the pace of increases can vary significantly by industry and region. Companies should anticipate the need for annual salary reviews and adjustments to remain competitive and compensate for the rising cost of living. Staying informed about regional market data and inflation rates will be crucial for effective salary planning in 2026.